The economy has entered a phase that economists describe as rare and markets often misprice: a simultaneous rise in growth and a decline in inflation. Three independent signals have converged to confirm that India has entered a new phase of consumption-led expansion.

After its monetary policy committee meeting on 5 December, the Reserve Bank of India declared that India has entered a “rare goldilocks period” of surging growth and cooling inflation and cut repo rate by 25 basis points to 5.25%. It also revised its FY26 GDP growth outlook to 7.3%.

RBI’s decision comes close on the heels of Fitch upgrading India’s FY26 growth forecast to 7.4%. The ratings agency based its decision on increased consumer spending—corroborated by Thurro’s Alt Data—and improved sentiment boosted by GST reforms and predicted a rate cut by RBI.

Taken together, the RBI’s policy shift and Fitch’s upgrade point to the same underlying story: India’s consumption engine has begun to accelerate, and the macro narratives are now catching up to what the data has been signaling for months.

RBI’s goldilocks moment

RBI’s 5th December policy statement is unusually direct in its assessment. Here are the key points from RBI’s statement:

- Inflation hit an unprecedented 0.3% in October 2025, the lowest in the history of India’s inflation-targeting framework. Most importantly, this is not an isolated month. The quarterly average inflation for Q2 FY26 fell to 1.7%, slipping below the RBI’s lower tolerance threshold of 2%. This gives the central bank enormous policy space.

- Growth accelerated to 8.2% in Q2 FY26, supported by a powerful combination of festive-season demand and GST rate rationalisation. This validates the idea that tax simplification and lower rates have begun to redirect consumption behaviour.

- RBI cut the repo rate by 25 bps to 5.25% and injected INR 1 trillion in durable liquidity, alongside a $5 billion buy-sell FX swap—an assertive move to support credit conditions and accelerate transmission.

- Rural demand, subdued for nearly two years, is now showing strong signs of revival. RBI highlights surging two-wheeler sales (51.8% YoY in October), lower MGNREGA demand (indicating improved farm employment), and supportive agricultural conditions. This is critical because the rural sector accounts for more than a third of India’s consumption.

The central bank is confirming a structural shift in both consumption and inflation dynamics.

“Despite an unfavourable and challenging external environment, the Indian economy has shown remarkable resilience. It is poised to register high growth. The headroom provided by the inflation outlook has allowed us to remain growth supportive. We will continue to meet the productive requirements of the economy in a proactive manner, while ensuring macroeconomic stability,” RBI governor Sanjay Malhotra said.

Fitch’s upgrade

Fitch’s revision of India’s FY26 growth forecast to 7.4% is another recognition that domestic demand has surprised on the upside, driven by:

- stronger household spending,

- better real incomes due to disinflation,

- the impact of GST rationalisation on price-sensitive categories, and

- broadening consumption across both urban and rural areas.

In effect, global analysts are acknowledging what the RBI has said: India’s growth is being driven by its households, not by external demand or government spending. This matters because household-led recoveries tend to be more durable when supported by real income gains and policy tailwinds—both of which are now present.

If the RBI and Fitch provide the macro narrative, Thurro’s Alt Data provides the ground truth—real-time evidence that households are actually spending more, more often, and across more categories.

AltData corroborates consumption picking up

Data from Thurro’s platform shows a broad-based rise in spending across digital channels, FMCG volumes, and rural demand indicators. View the Thurro Answers Notebook on consumer spending analysis here.

- Alt Data shows digital retail spending (UPI + debit + credit card spending) has grown 18%–36% YoY for 24 consecutive months. This is a behavioural shift. Indian consumers are more comfortable with high-frequency, digital transactional spending, especially in discretionary categories.

- Private final consumption expenditure growth hit 7.5% in Q1 FY25—a seven-quarter high after years of weakness. This confirms that household demand had already bottomed out last year.

- FMCG rural volume growth reached 9.2% in Q4 FY25, more than double urban growth of 4.2% in the same quarter. Rural wage growth has also remained firm, ranging between 5.8% and 7.3% in recent months, reinforcing purchasing power. Combined with good monsoons and high reservoir levels, rural households now have both spending power and confidence—conditions missing for nearly three years.

Thurro NowCast consistently flagged inflation cooling

Thurro’s inflation NowCast for India’s food & beverage CPI has delivered over two years of near-perfect tracking against MOSPI’s official CPI print for food and beverage inflation. Thurro offers this insight at the start of the month offering stakeholders a 10-15 day headstart compared to the eventual official announcement.

Powered by a continuously refreshed alternate dataset—spanning mandi prices, major e-commerce platforms and commodity feeds—the NowCast offers a statistically aligned early read on food-price movements well before the official release.

For November 2025, the NowCast projects –3.24% food and beverage inflation, marking one of the sharpest disinflation prints in several years and a dramatic reversal from 8.20% in the same month last year.

What it means

This alignment is rare. Read together, these indicators point to a clear structural inflection:

- Consumers are spending more frequently and more confidently.

- Rural demand has re-entered the cycle with surprising strength.

- Inflation is the lowest in a decade, boosting real incomes.

- Policy is now overtly growth-supportive.

- Supply chains are scaling in tandem with household demand.

The convergence of household spending, rural recovery, benign inflation and supportive policy suggests that India is moving from a narrow, urban-led recovery to a more balanced and sustainable growth. With real incomes rising, rural demand re-entering the equation, and policy firmly supportive, the foundations of growth are deeper and more durable than they have been in years. The question now is whether India can convert this consumption momentum into a sustained investment cycle.

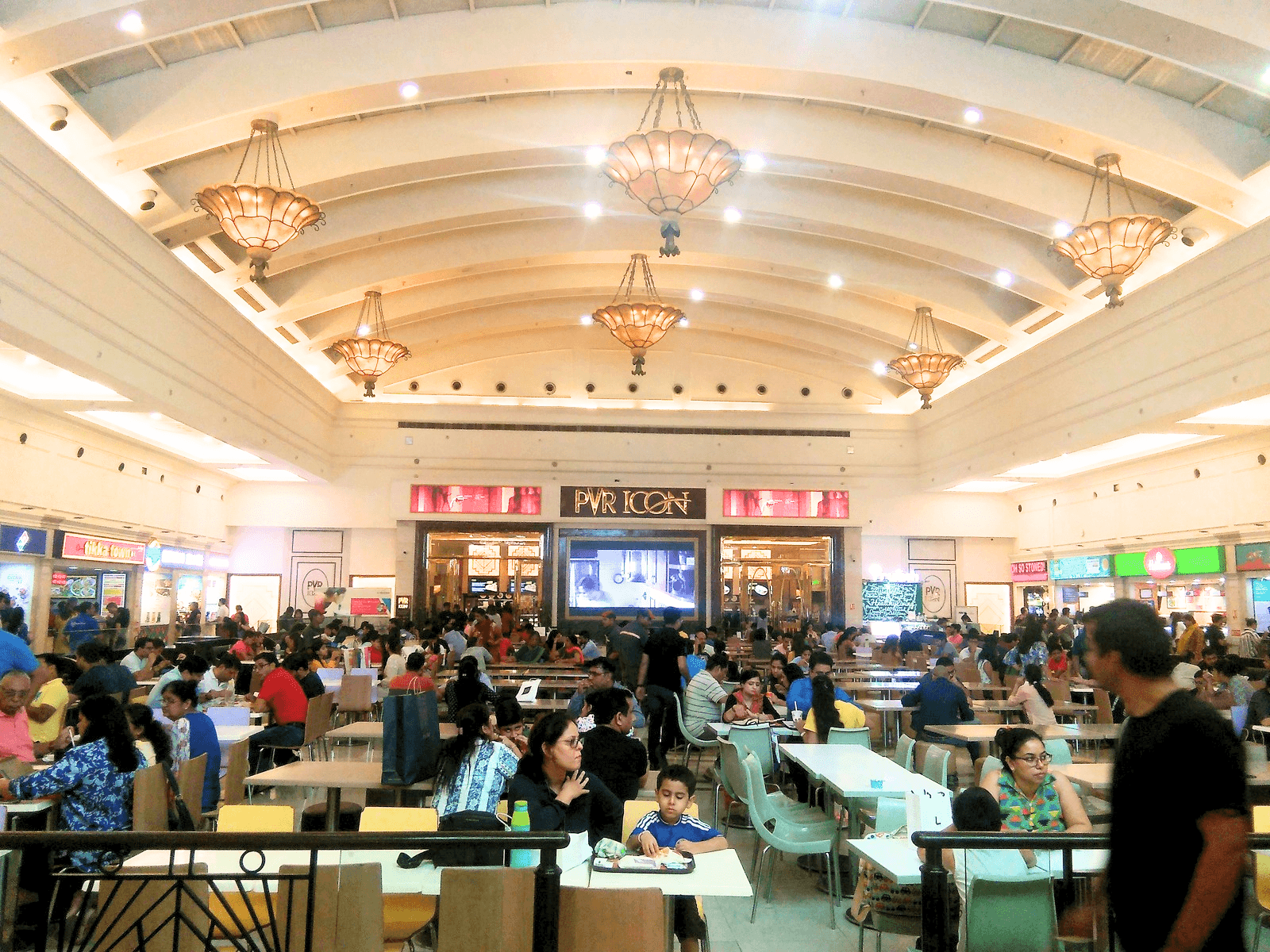

Cover photo credit: Rajat Chakraborty on Unsplash

View disclaimer

Unlock the power of alternative data

Do not just follow the market — stay ahead of it. Thurro helps you transform raw filings and alternative datasets into actionable insights.

Explore Thurro AltData Book a demo