Over the past decade, UPI has emerged as the central payment rail of India’s digital economy. Its growth is routinely described through headline figures: transaction counts, transaction values, and record-breaking monthly milestones. These numbers capture scale, but they offer limited insight into how consumption behaviour itself has changed as UPI has moved from novelty to infrastructure.

This distinction matters. A payments system can grow because people spend more per transaction, or because they transact more often. These two dynamics imply very different behavioural, commercial, and policy outcomes. Most public commentary implicitly treats UPI’s growth as a single phenomenon, without separating scale from usage patterns.

This note takes a different approach. Using long-lens UPI data, it asks a simple but underexplored question: has UPI changed how much Indians spend—or how often they spend?

From scale to behaviour

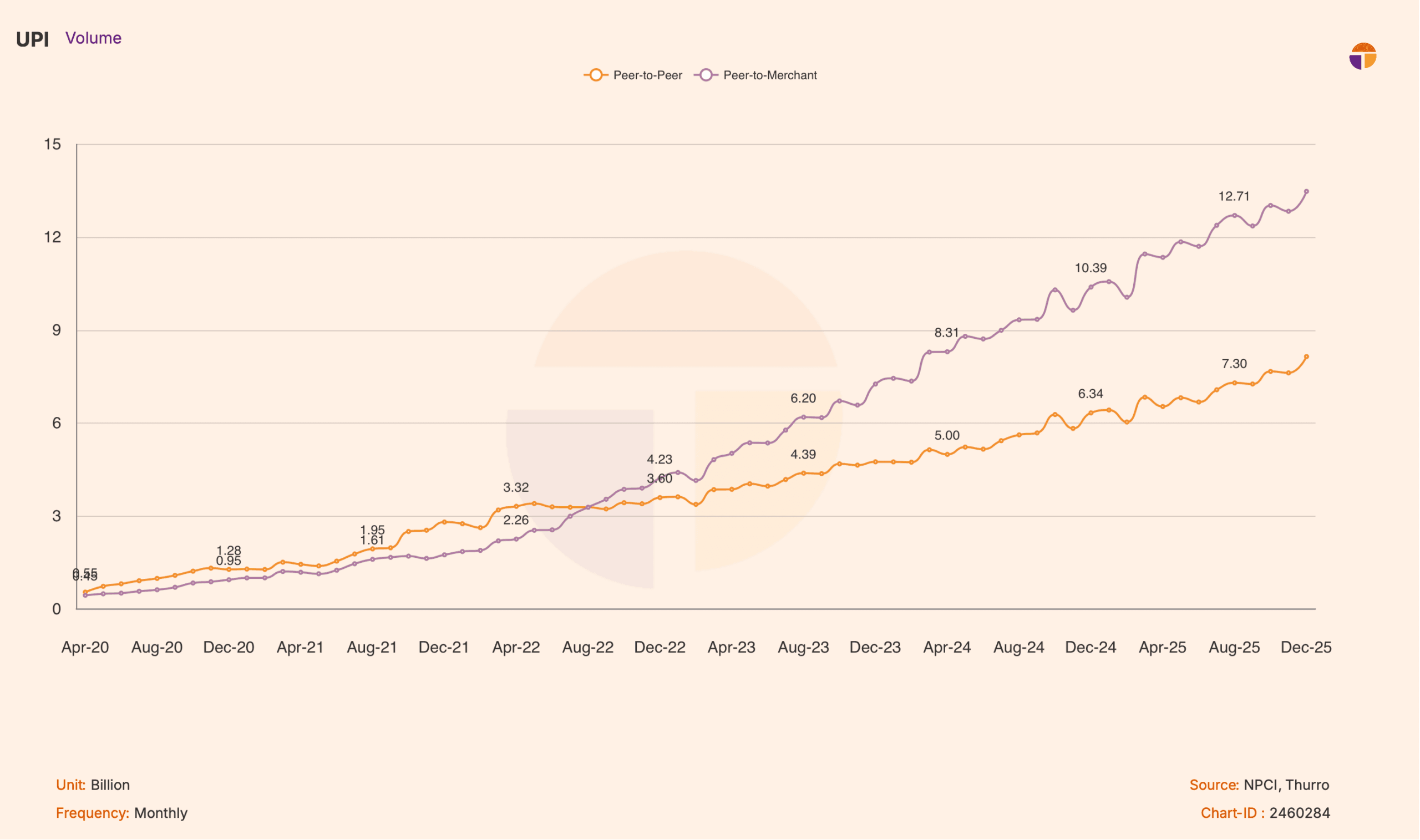

UPI’s rise is most often described in terms of scale. Over time, both transaction volumes and values have expanded rapidly, reflecting widespread adoption, merchant onboarding, and the steady broadening of use cases across the economy.

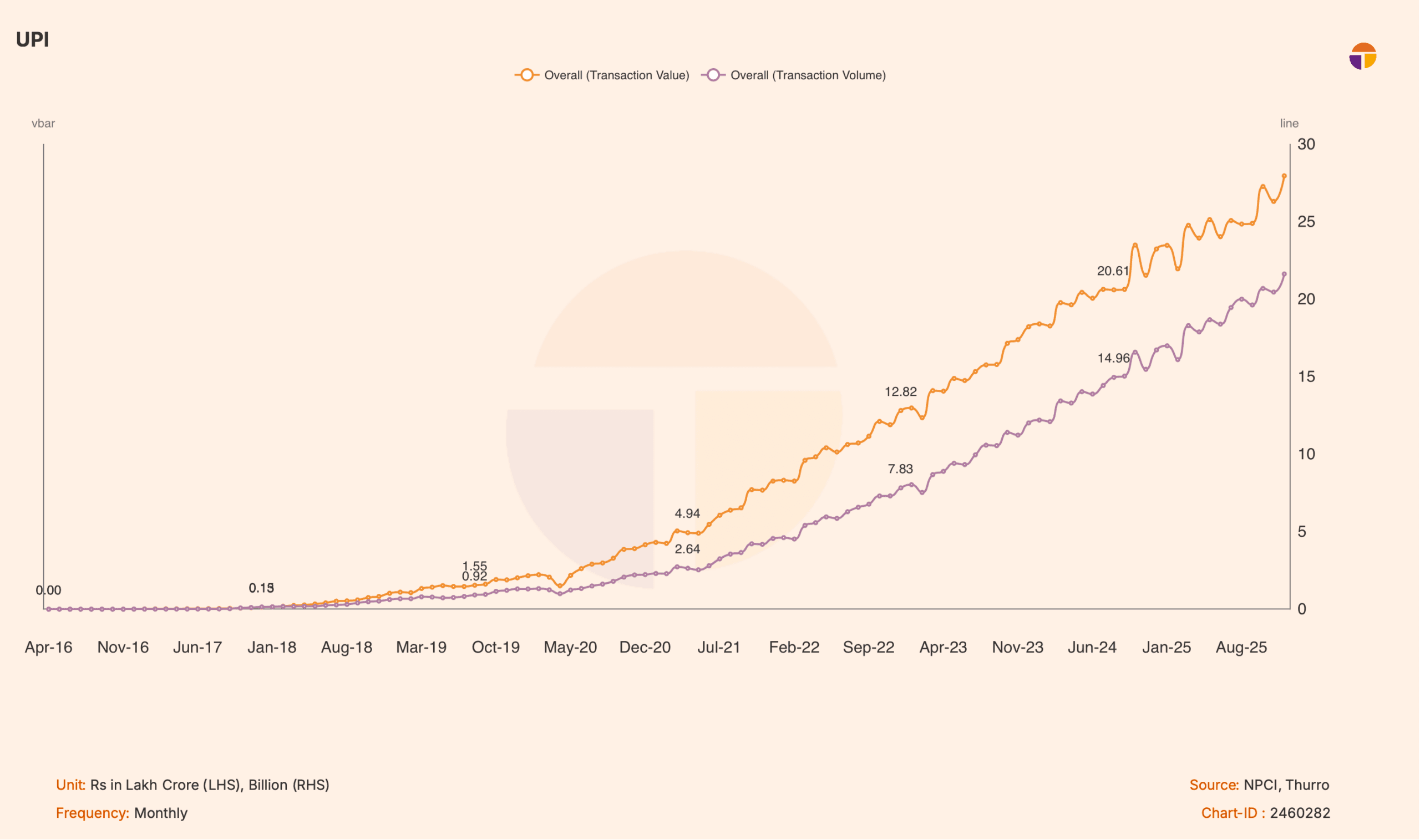

Chart 1: UPI total transactions; volume and value, over the past decade

This long-lens view establishes the magnitude of UPI’s expansion. It shows how quickly the system scaled once network effects took hold. On its own, however, absolute growth does not explain how consumption behaviour has changed as UPI moved from build-out to maturity.

To examine that shift, it is necessary to look beyond scale and compare how transaction volumes and values have grown relative to each other.

From value-led scale-up to frequency-led participation

During the early years of UPI’s rollout, growth was dominated by transaction values rather than transaction counts. Indexed to the system’s initial phase, transaction values rose faster than volumes, consistent with a build-out period characterised by onboarding, higher-ticket transfers, and the migration of new use cases onto the platform.

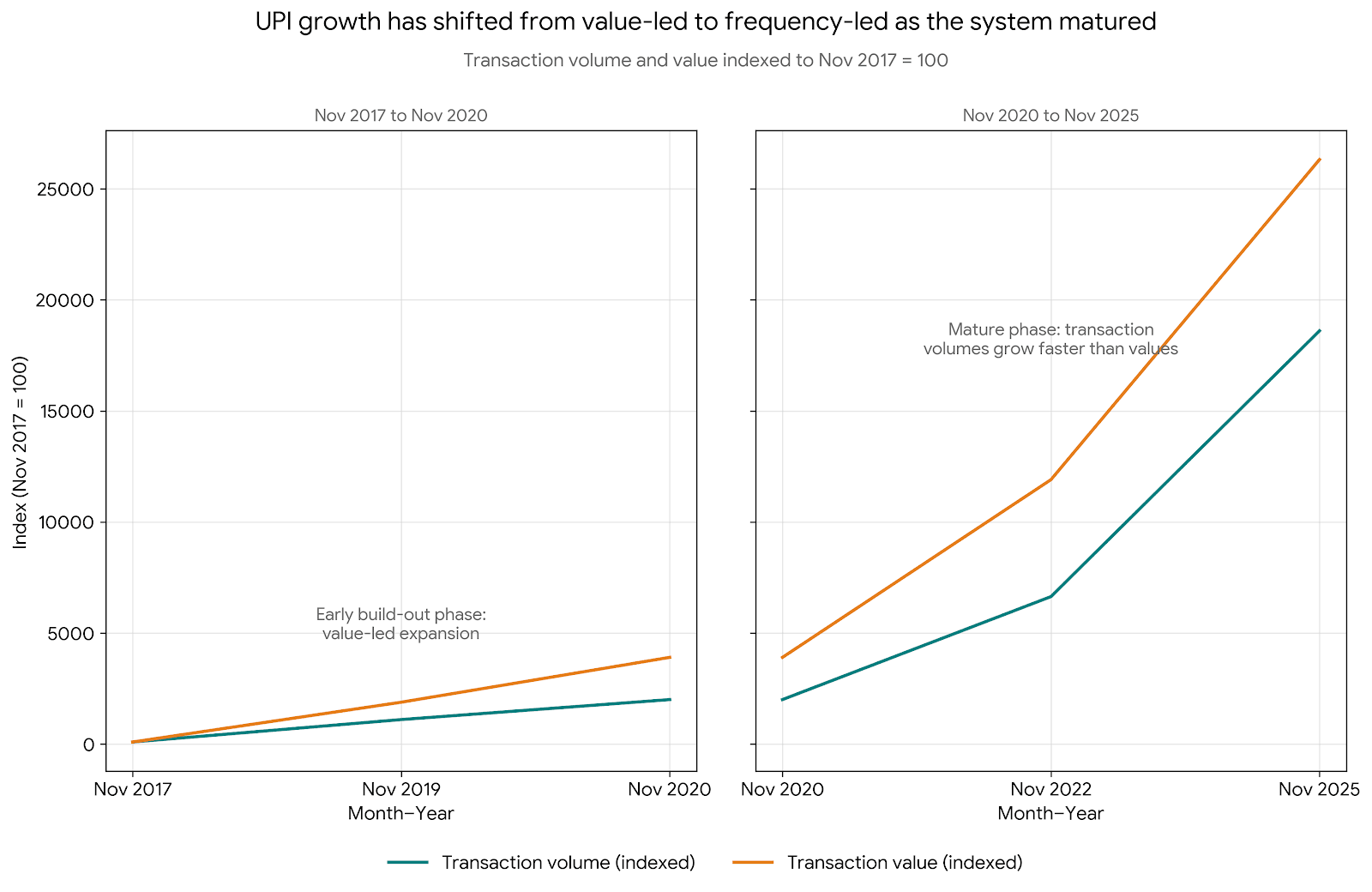

Chart 2: Indexed UPI transaction volume versus value with November 2017 taken as base

This indexed comparison highlights a value-led expansion phase. Growth during this period reflects scale formation rather than stabilised usage patterns. As UPI matured, however, the relationship between volumes and values began to change. Re-indexing transaction volumes and values to a later base makes this shift clearer.

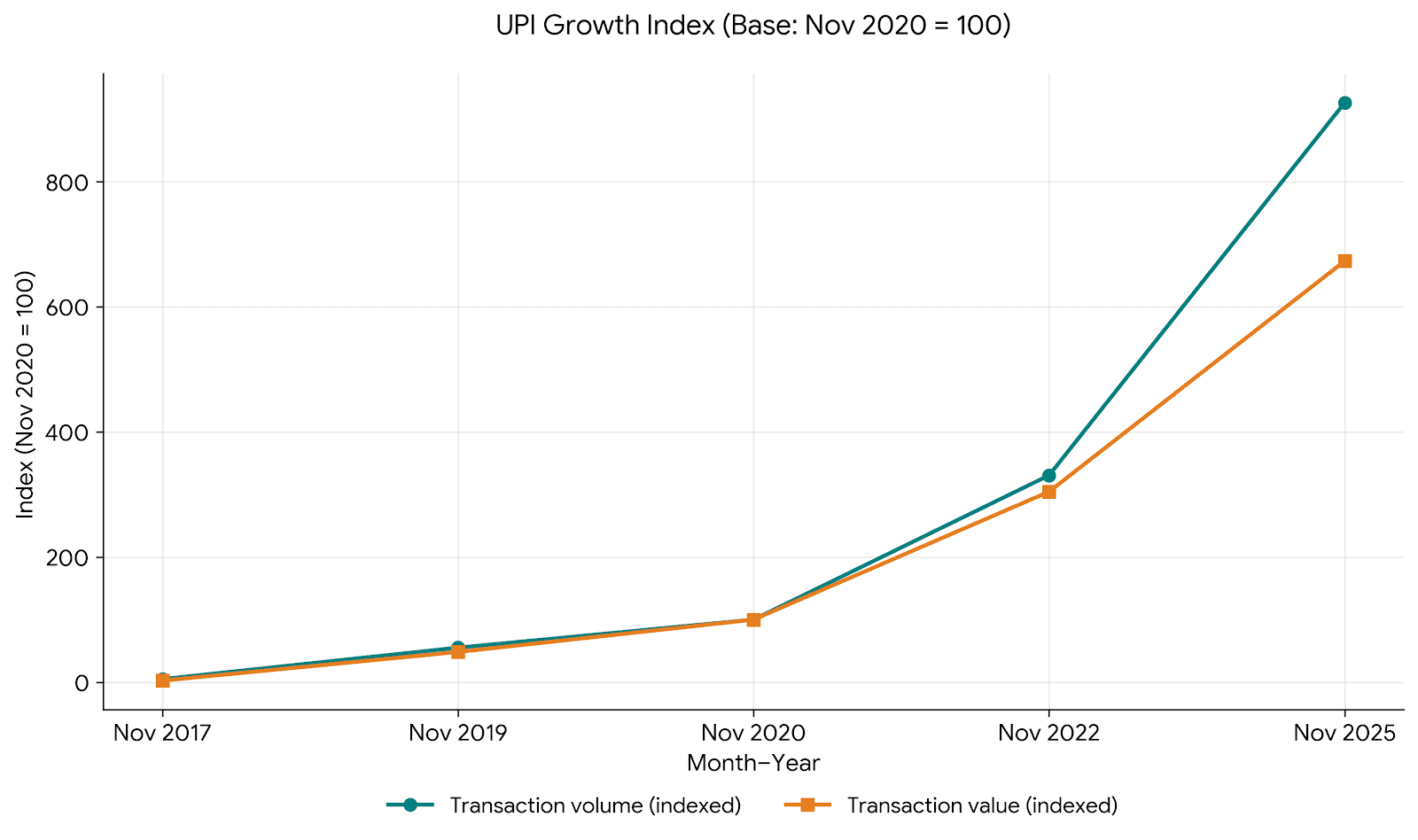

Chart 3: Indexed UPI transaction volume versus value with November 2020 taken as base

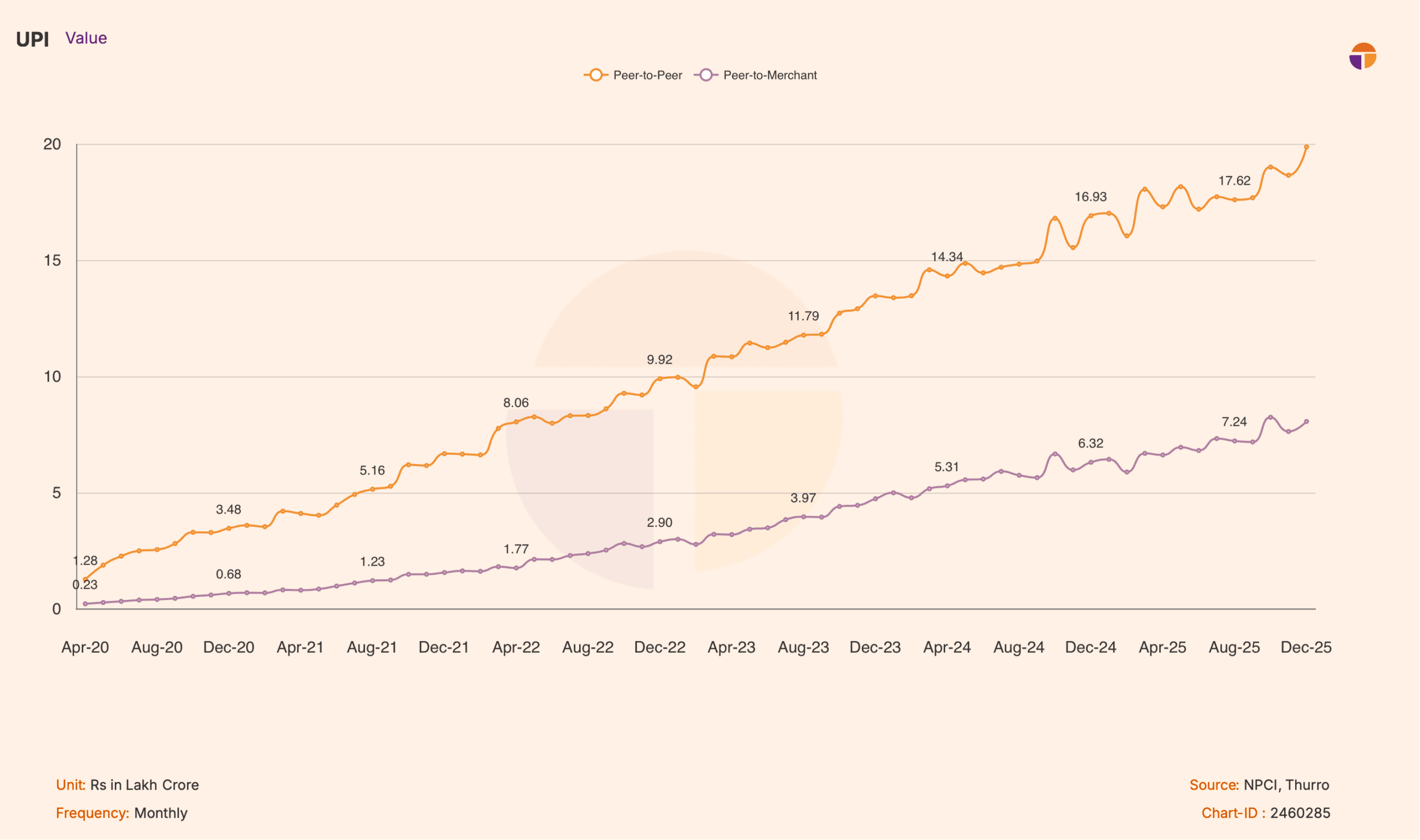

In the post-scale phase, transaction volumes have grown faster than transaction values. While value growth remains strong, the acceleration in volumes points to a change in how the system is being used. Growth is increasingly driven by frequency—more transactions conducted more often—rather than by rising transaction sizes.

Taken together, the two indexed views suggest that UPI’s expansion has moved from a value-led scale-up to a phase defined by participation intensity. The system is no longer shaped primarily by the size of transactions being routed through it, but by how embedded it has become in routine economic activity.

Falling ticket sizes and granular participation

The shift from value-led to frequency-led growth is visible at the level of individual transactions. As UPI usage has matured, average transaction sizes have declined, particularly in peer-to-merchant (P2M) payments.

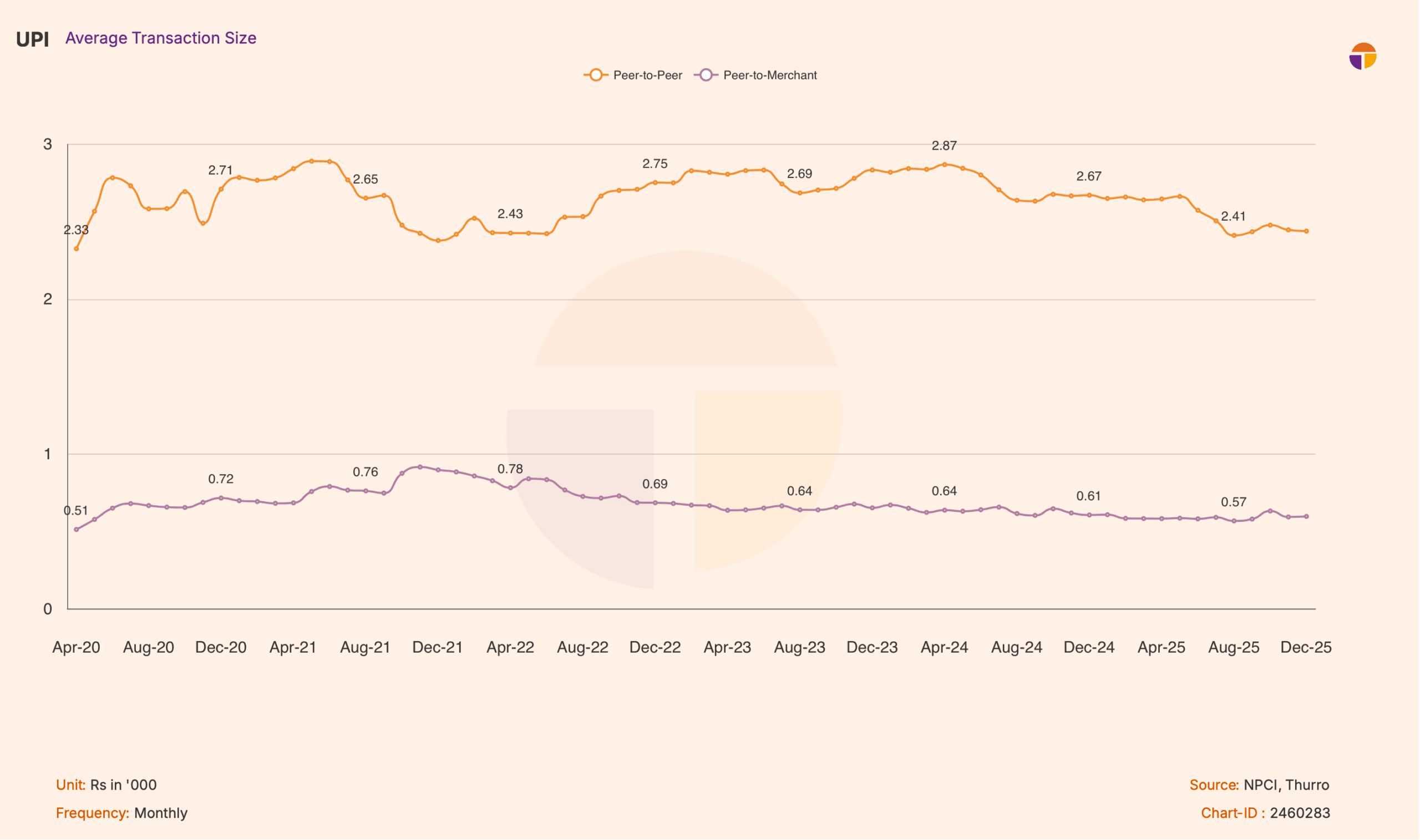

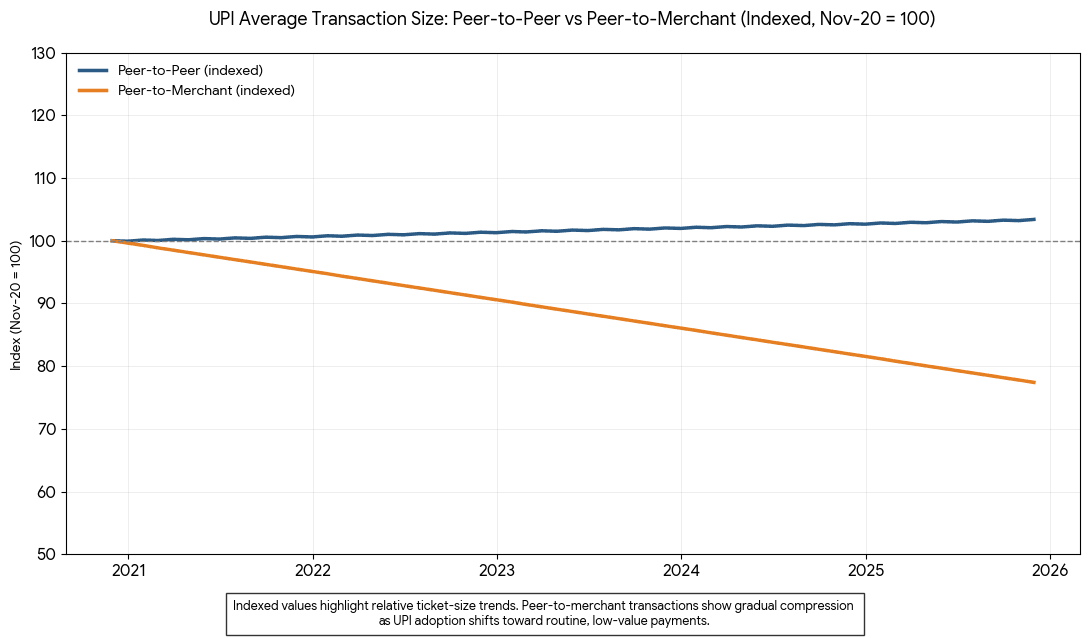

Chart 4: Average transaction size—P2P versus P2M

Indexed transaction data shows that peer-to-merchant (P2M) ticket sizes have steadily declined since late 2020, while peer-to-peer (P2P) transaction sizes have remained broadly stable.

This divergence matters. It indicates that UPI’s expansion is being driven not by larger merchant payments, but by repeated, routine transactions across a widening merchant base. In practice, UPI is increasingly mediating everyday economic activity—groceries, food, utilities, fuel—rather than facilitating episodic, higher-value transfers.

Chart 5: Average transaction size—P2P versus P2M, indexed (Nov 2020 = 100)

This pattern aligns with the indexed evidence presented earlier. Growth is increasingly being driven by a larger number of smaller transactions. The volume composition of UPI reinforces this interpretation. P2M transactions now account for the majority of transaction counts, indicating that most interactions on the network are low-value, high-frequency payments tied to daily consumption.

Chart 6: P2P versus P2M volume mix over the years

By contrast, P2P transactions continue to account for a larger share of transaction value. This reflects the continued role of UPI in remittances and higher-ticket transfers, even as everyday commerce becomes increasingly merchant-facing.

Chart 7: P2P versus P2M value mix over the years

Taken together, these patterns suggest that UPI’s growth is no longer primarily about moving larger sums through the system. Instead, it reflects deeper participation: more users, transacting more often, across a widening base of low-ticket, routine economic activity.

Merchant payments and the institutionalisation of usage

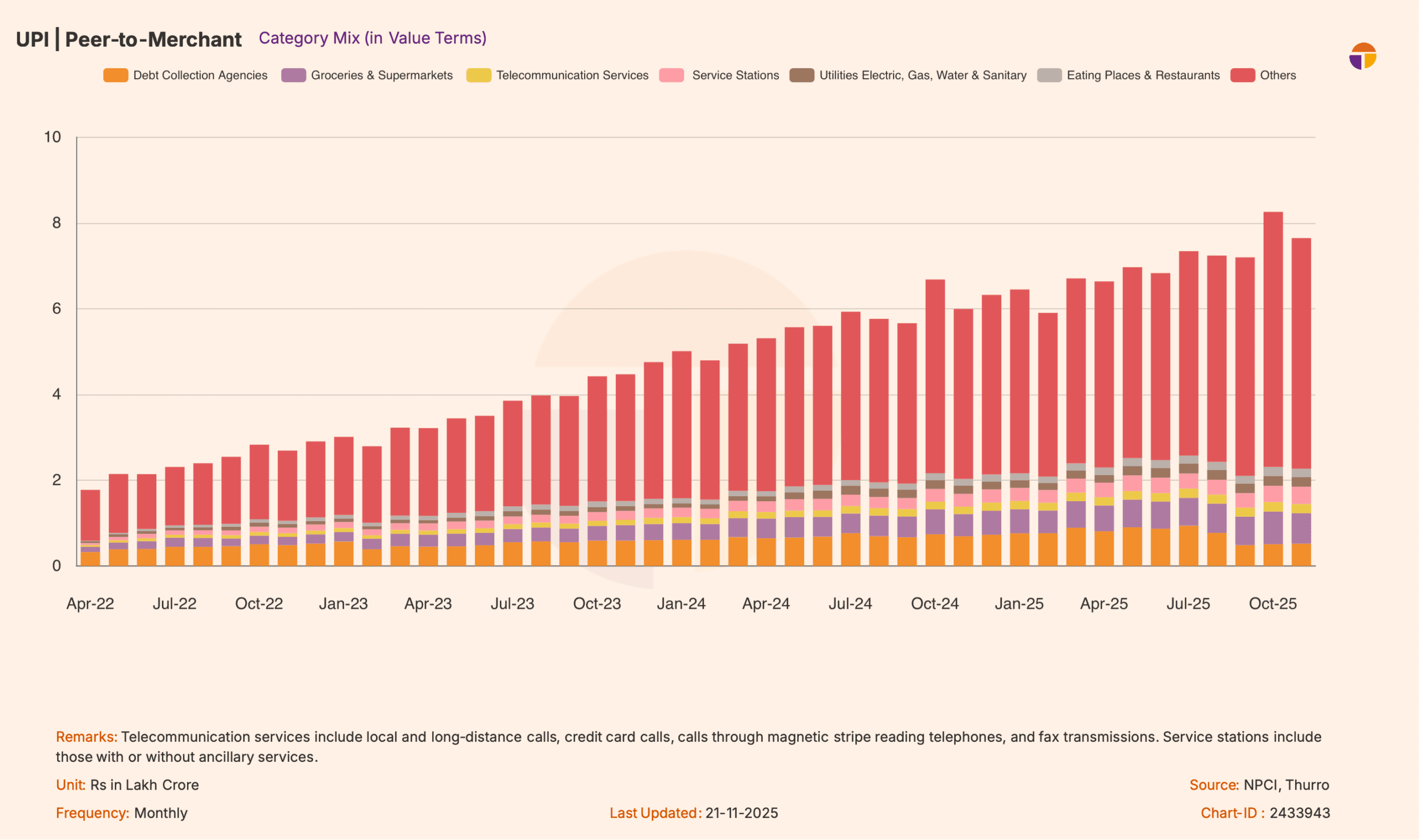

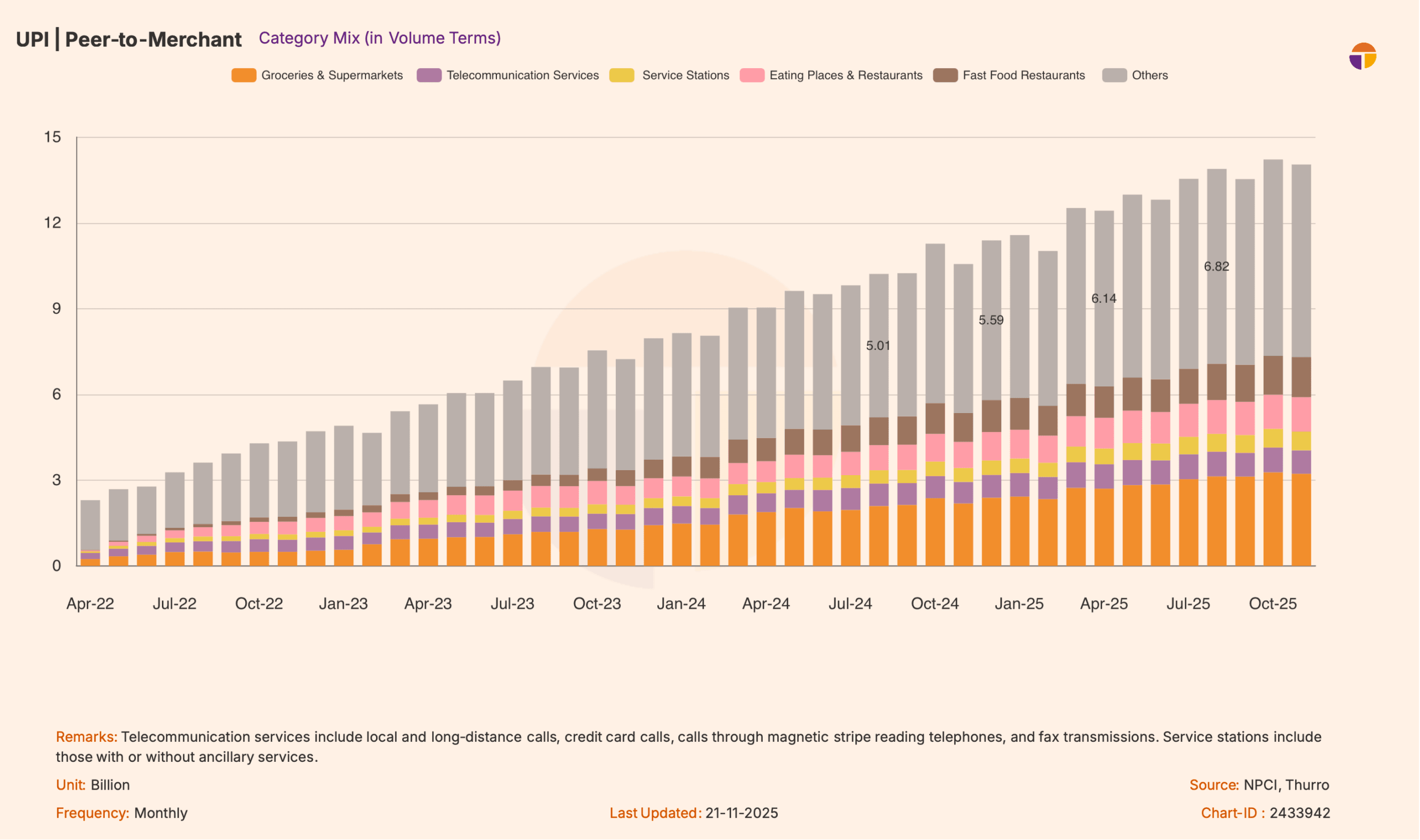

The shift toward higher-frequency transactions becomes economically meaningful only if it is anchored in everyday commercial activity. Peer-to-merchant data shows that this is increasingly the case. As UPI has matured, growth in merchant payments has not been confined to a narrow set of use cases. Instead, it has spread across a widening range of categories, indicating that UPI is being embedded into multiple layers of routine economic life.

Viewed in value terms, merchant payments reflect the steady expansion of UPI into essential services, retail consumption, and recurring expenditure categories. Larger-ticket categories continue to contribute meaningfully to aggregate value, underscoring UPI’s role as a general-purpose payment rail rather than a retail tool.

Chart 8: P2M category mix—value terms

The behavioural signal is clearer in transaction volumes. In volume terms, growth is concentrated in categories associated with high-frequency, low-ticket usage—such as groceries, food services, fuel, and everyday services. These categories dominate transaction counts even when they contribute a smaller share of total value.

Chart 9: P2M category mix—volume terms

This divergence between value and volume matters because it shows that UPI’s growth is being driven by repeated, routine payments across a wide merchant base rather than by fewer high-value transactions. Category mix data reinforces this reading, with growth concentrated in low-ticket, high-frequency segments such as groceries, food services, utilities, and fuel.

These categories overlap closely with segments where quick commerce has expanded, suggesting that both reflect a broader shift toward more granular, time-sensitive consumption. Together, this points to UPI’s transition from a peer-transfer tool to an infrastructure embedded in everyday spending.

UPI as a higher-frequency transaction rail

As UPI usage has shifted toward smaller, more frequent payments, it increasingly functions as a high-frequency transaction rail.

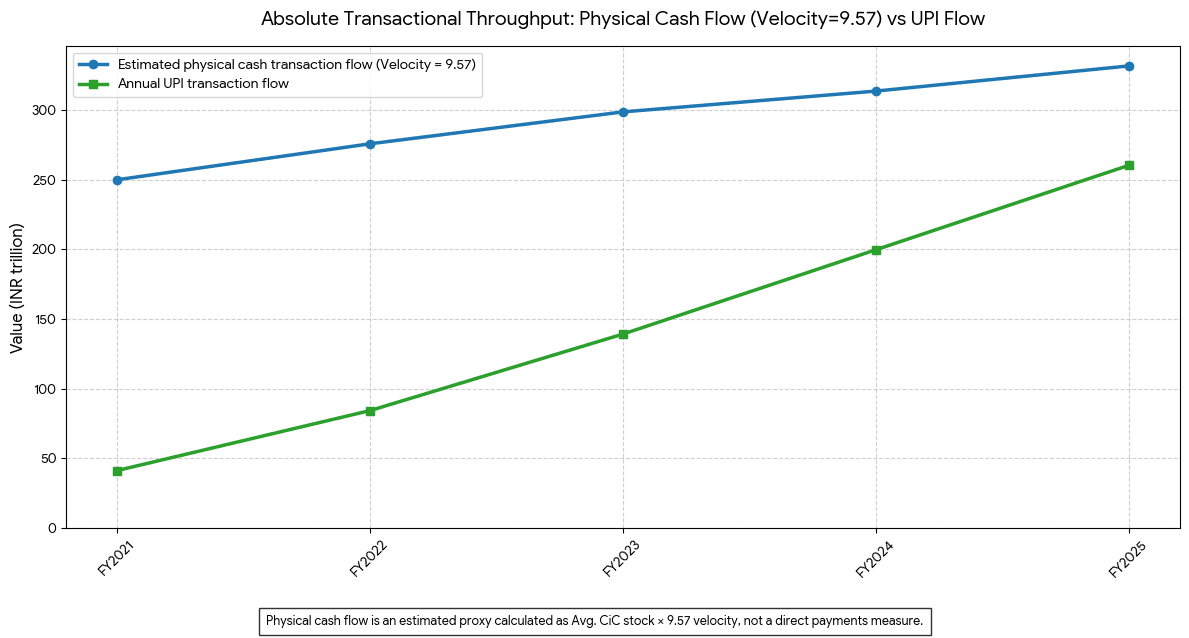

To place this shift in context, it is useful to compare UPI’s observed transaction flow with the implied transactional throughput of the physical cash economy. Physical currency is measured as a stock; its usage must therefore be inferred by applying estimates of velocity. UPI, by contrast, is measured directly as a flow.

Viewed side by side, a structural divergence is evident. While the implied transactional flow supported by physical cash has expanded steadily over time, UPI’s transaction flow has grown far more rapidly, particularly after FY2021.

UPI scaled from INR 69.5 billion of transactions in FY2017 to INR 260.5 trillion by FY2025. Over the same period, the estimated physical-cash-supported economic throughput—proxied by nominal GDP—rose from INR 153.9 trillion to INR 330.7 trillion.

This comparison is not intended to imply that UPI substitutes for physical cash alone. UPI transactions span use-cases historically served by multiple payment instruments, including cheques, NEFT, and IMPS, particularly for collections, recurring payments, and merchant settlements. The comparison instead highlights the speed at which UPI has scaled transactional throughput relative to the broader economic base, irrespective of the payment instrument involved.

In this sense, UPI’s expansion reflects consolidation across payment rails rather than a one-for-one replacement of any single instrument.

Chart 10: GDP versus UPI flow

In absolute terms, UPI transaction flow has reached roughly four-fifths of the scale of the cash-supported economic base within less than a decade. The gap continues to narrow. In the first two quarters of FY2026, UPI transactions totalled INR 147.9 trillion, equivalent to over 86% of the implied physical-cash economic flow of INR 171.3 trillion over the same period.

If current trajectories persist, UPI’s annual transaction throughput is on course to exceed the implied physical-cash economic flow within the next six-eight quarters.

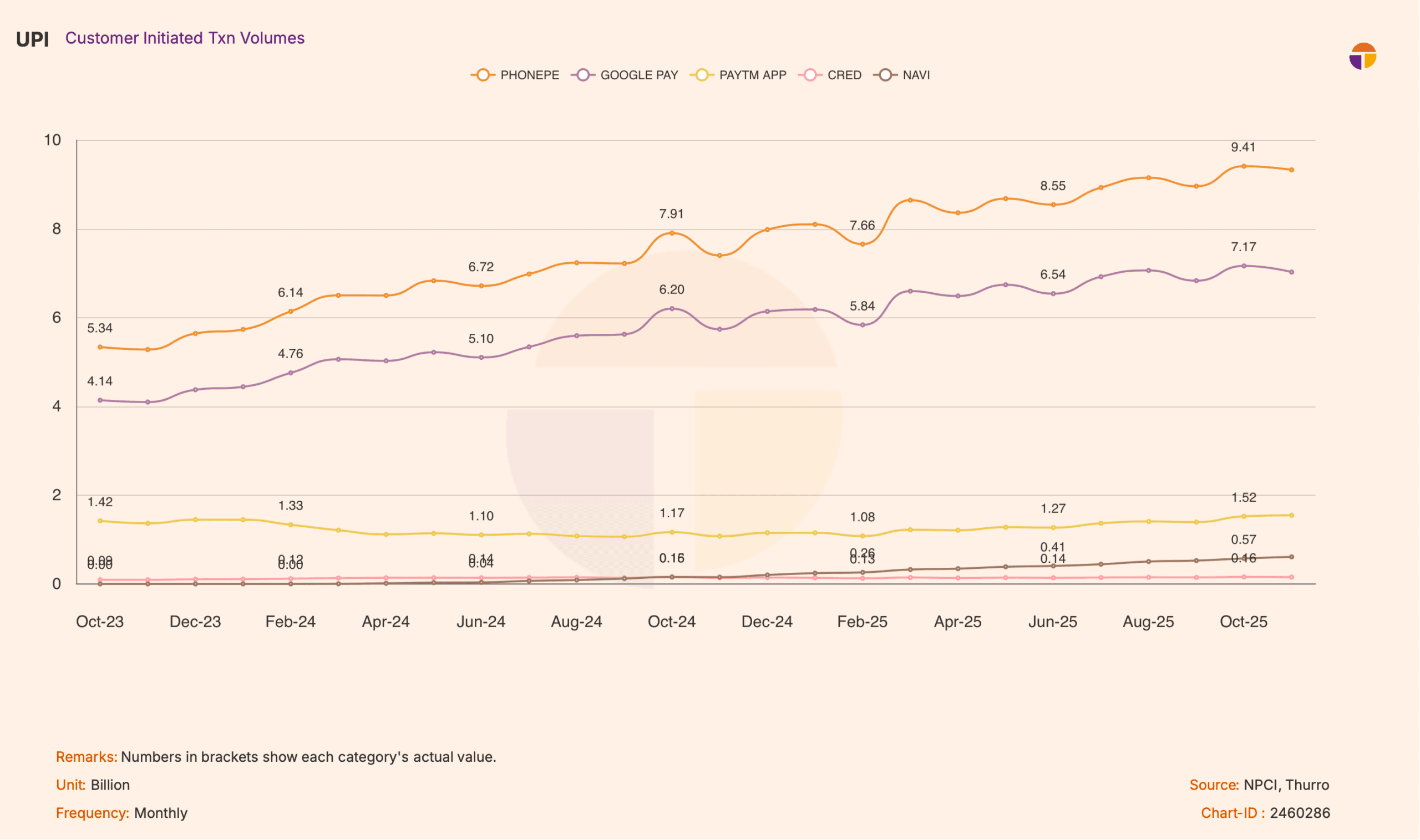

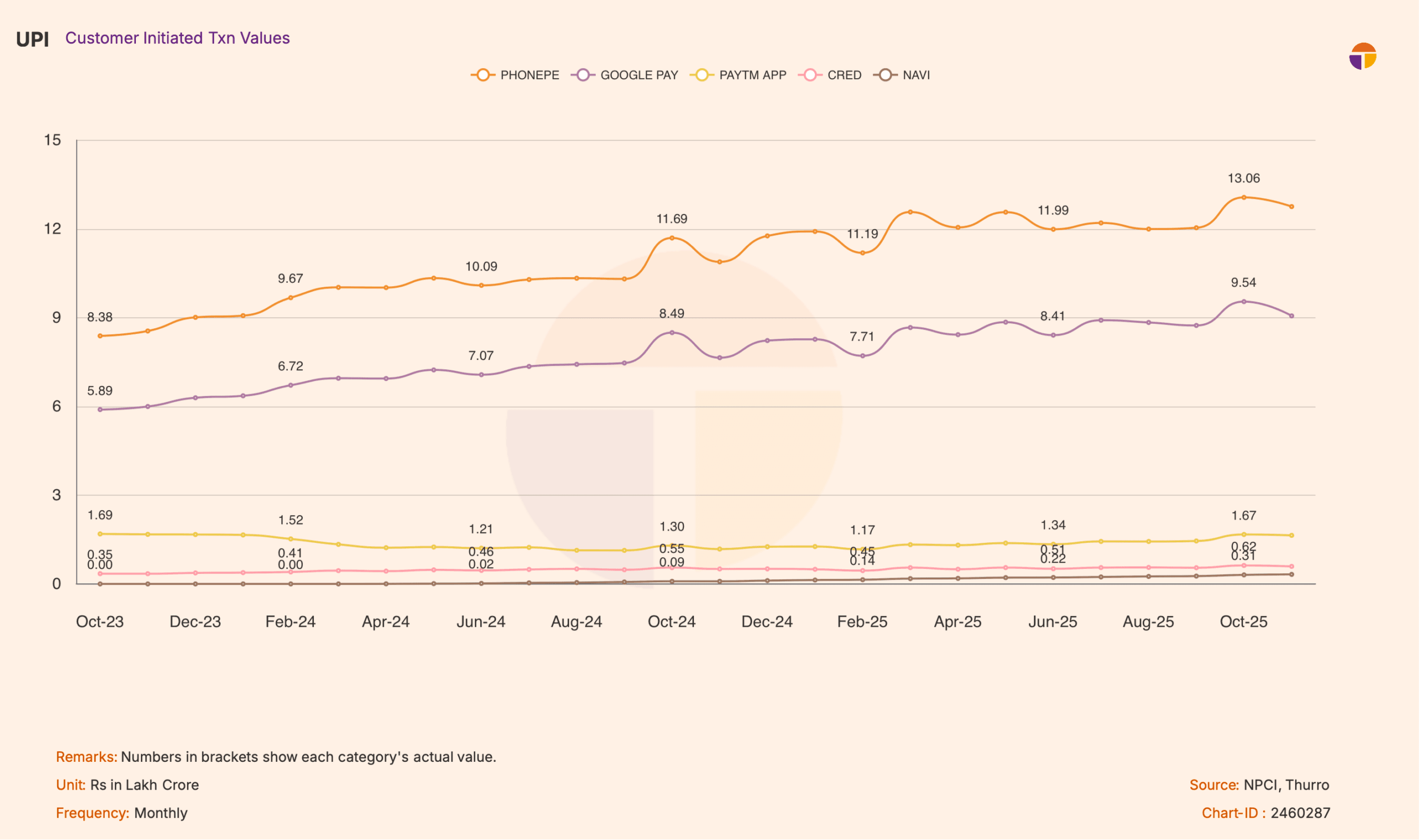

Concentration, stability, and observability

UPI usage is concentrated across a small number of applications, with PhonePe and Google Pay accounting for a large and relatively stable share of transaction volumes and values.

Chart 11: App-level market share—volumes

Chart 12: App-level market share—values

The analytical significance of this concentration is not competitive structure per se, but stability. Despite regulatory intent to limit app-level concentration—including NPCI’s 30% market share cap announced in November 2020 and originally slated to take effect by end-2024—UPI usage has continued to route overwhelmingly through a small number of platforms, with the cap’s implementation since deferred to December 2026.

This stability has second-order implications. Utility-like usage routed through a stable platform layer produces consistent, high-frequency data exhaust. Over time, this increases the observability of everyday economic activity relative to a predominantly cash-based system. If appropriately anonymised and aggregated, such data—particularly at granular levels such as pin codes or merchant categories—could enable far more localised measurement of consumption dynamics, offering policymakers and researchers a new lens on economic activity without relying solely on infrequent surveys or indirect proxies.

Conclusion

UPI’s evolution can be understood in two broad phases. The early phase was defined by value-led scale-up, as users and merchants were onboarded and new use cases migrated onto the system. The more recent phase has been characterised by faster growth in transaction frequency, declining average ticket sizes, and merchant-dominated usage.

This distinction answers the question posed at the outset. UPI has not necessarily increased the size of individual spending decisions. It has increased how often individuals participate in the economy.

As the system matures, UPI increasingly resembles a public utility for everyday commerce—one that reshapes the rhythm of consumption and makes economic participation more continuous, granular, and observable.

Cover photo credit: Unsplash

View disclaimer

Unlock the power of alternative data

Do not just follow the market — stay ahead of it. Thurro helps you transform raw filings and alternative datasets into actionable insights.

Explore Thurro AltData Book a demo