IndiGo’s network just became harder to challenge.

Thurro’s data shows the airline’s competition-free available seat kilometres (ASK) as a percentage of its overall ASK recorded a noticeable bump in November 2025.

After several months of holding steady around 24–25%, IndiGo’s share of uncontested ASK jumped to 28.75% earlier this month. The last time IndiGo saw a shift of this magnitude was in mid-2023, when GoFirst’s (formerly GoAir) bankruptcy abruptly removed capacity from several routes, widening IndiGo’s competition-free footprint.

Thurro’s forward-looking platform suggests this higher range of 27–28% could remain intact through early 2026.

IndiGo’s competition-free capacity available seat kilometres rose from around 24–25% to around 29% of total ASK by November 2025

But what is ASK?

Average seat kilometres, or ASK in aviation parlance, measures an airline’s passenger-carrying capacity. It is calculated by multiplying total available seats on a flight by the distance that flight travels.

A higher ratio of competition-free ASK to overall ASK would mean IndiGo is flying to routes where it is facing no competition. Such monopoly routes give the airline better pricing power and stronger yields.

What this shift means

A jump of more than 300 basis points—one basis point is one-hundredth of a percentage point—in competition-free capacity signals a structural change in IndiGo’s network mix. At first glance, it looked like this was simply the result of IndiGo adding more destinations. But a deeper look reveals that the shift is driven not by a single factor, but by a stacking of four network forces that all push the metric upward simultaneously.

What is driving IndiGo’s higher competition free ASK?

Regional market penetration: IndiGo expanded to 94 destinations in Q2 FY26, adding airports like Hindon (Ghaziabad), Jalandhar, and Purnea—markets that typically support only a single carrier due to limited demand and infrastructure.

Fleet expansion capability: With an order book of 900+ aircraft across the A320NEO, A321NEO, and A321XLR family, IndiGo can activate new routes faster than competitors, capturing uncontested sectors early.

Together, these factors create a compounding effect that pushes IndiGo into a higher structural band of uncontested flying.

Why the bump matters

A higher share of competition-free flying gives IndiGo:

- greater yield stability,

- more headroom on fares in regional and mid-haul markets; and

- a deeper competitive moat, making rival responses costlier and slower.

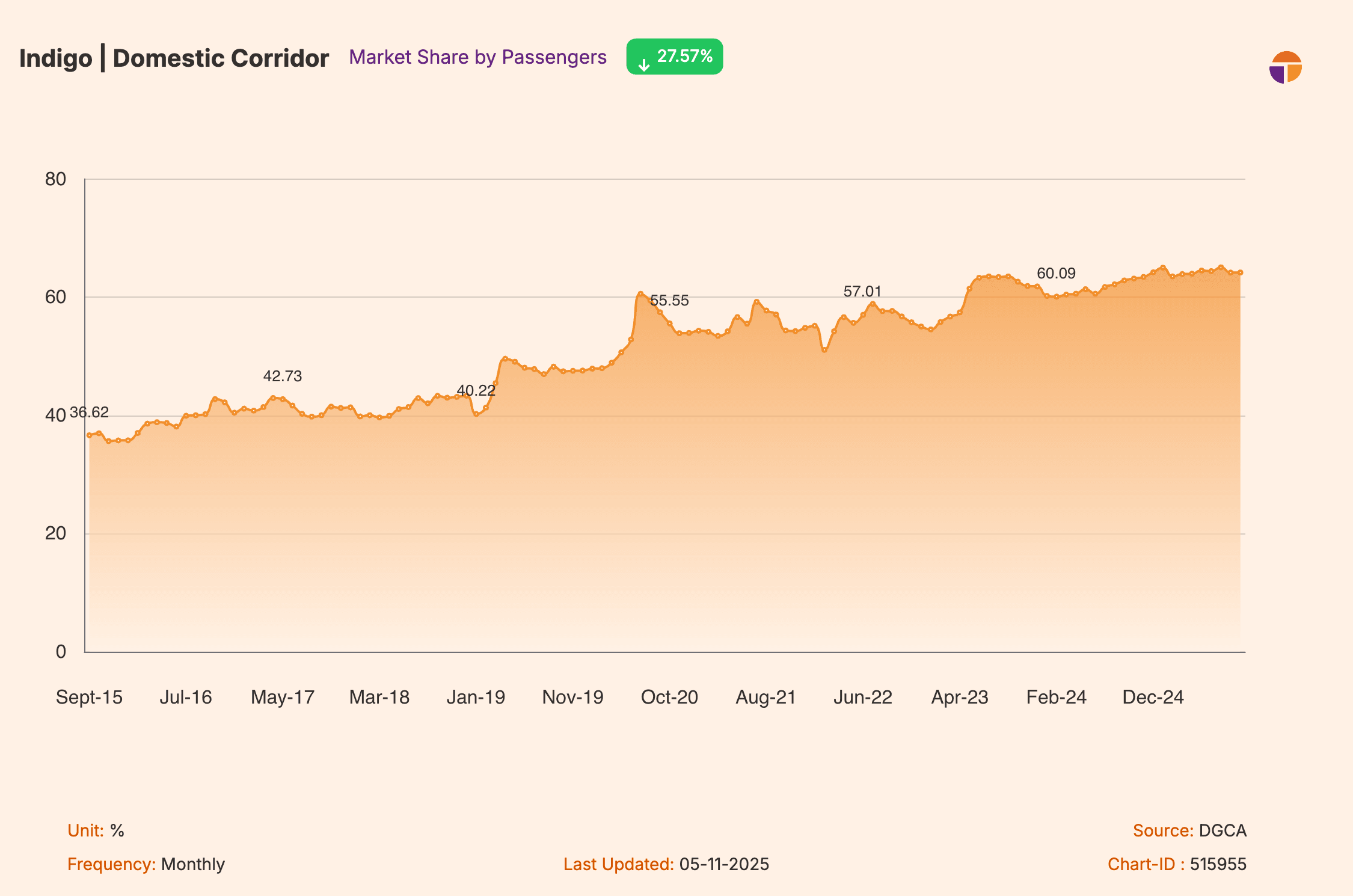

IndiGo’s domestic passenger market share increased steadily to over 60% by FY25

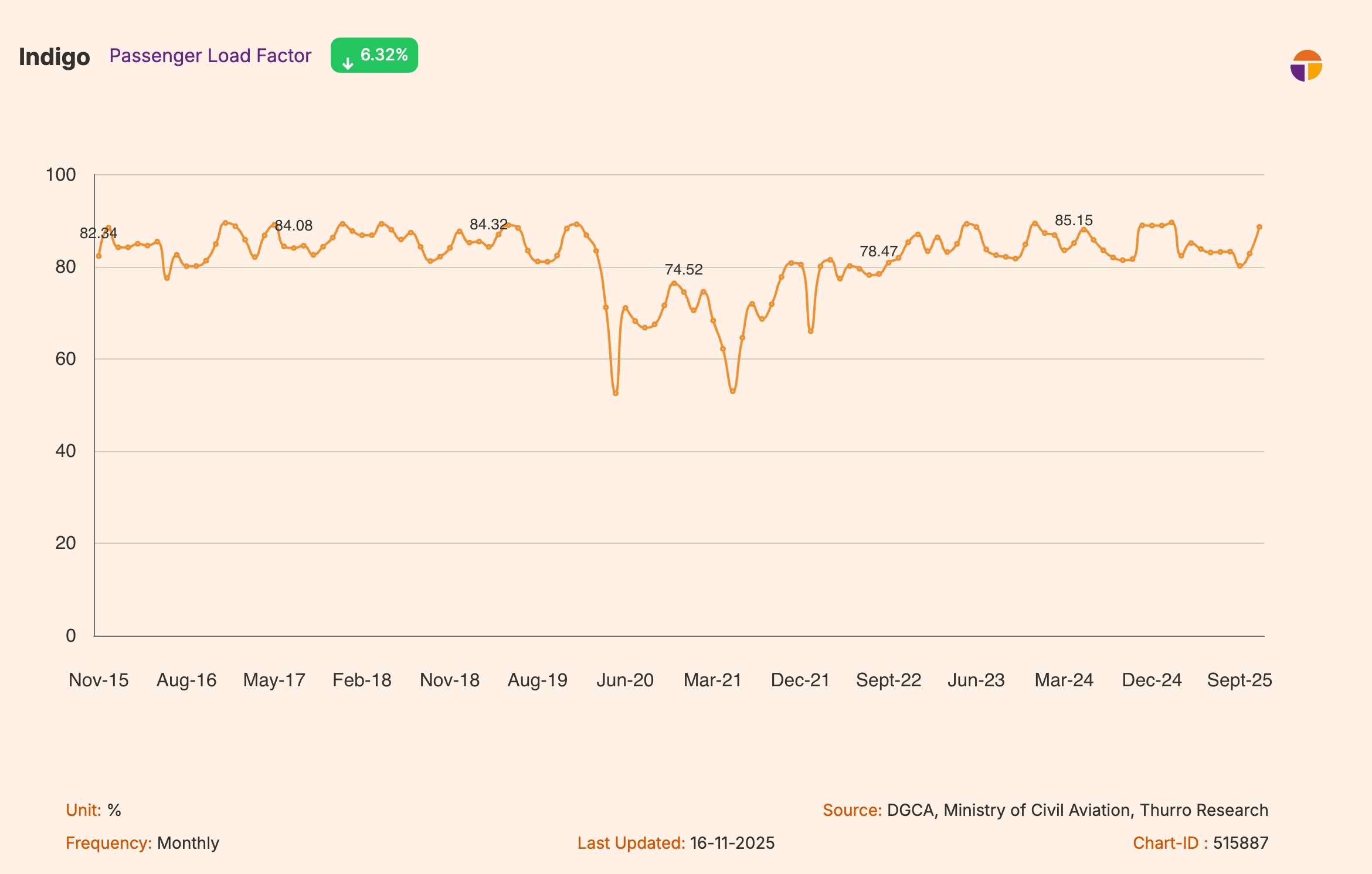

IndiGo’s passenger load factor remained largely stable in the 80–85% range over the past decade

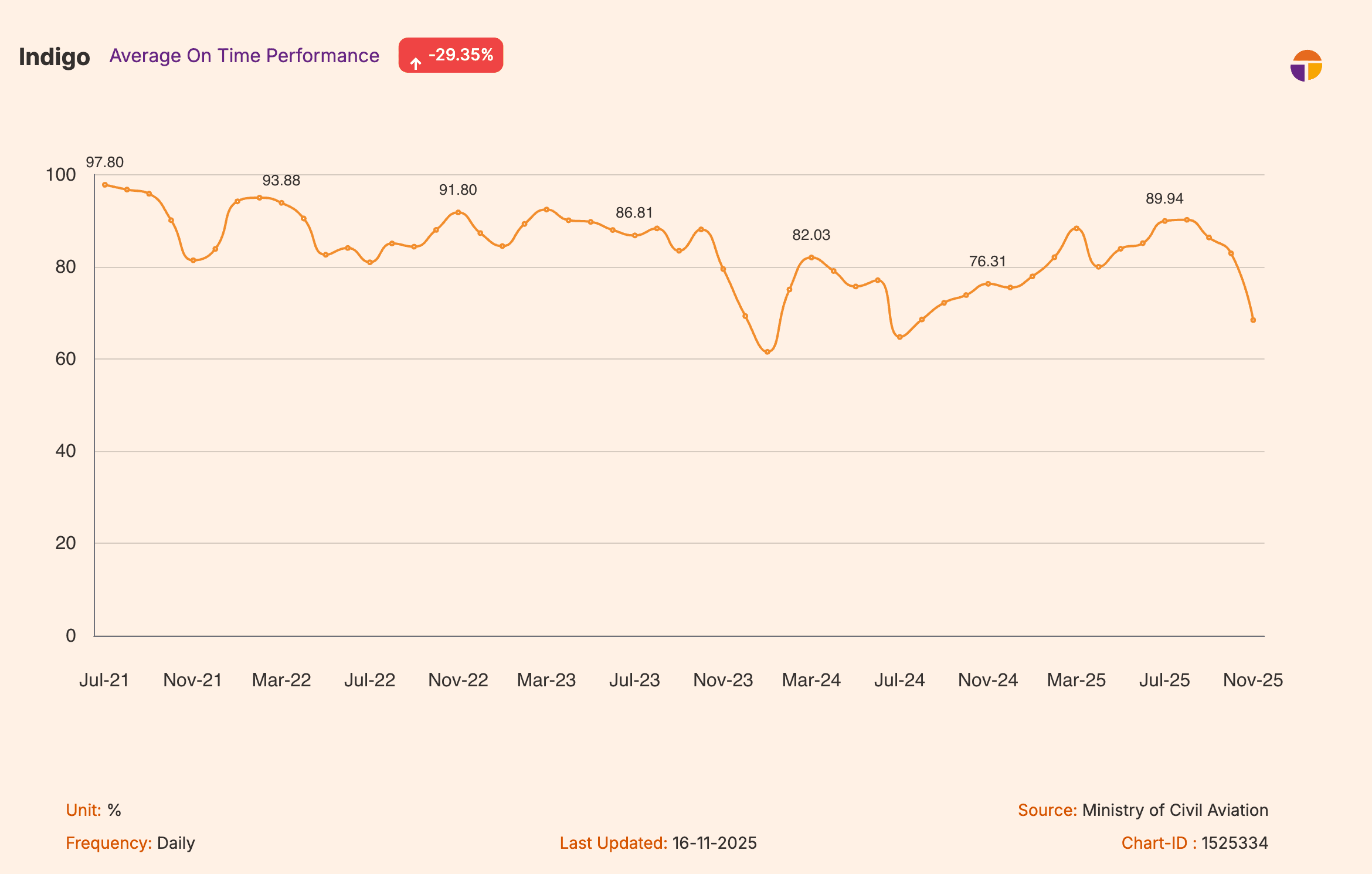

And while on-time performance has softened from its peak, the airline continues to operate within a stable mid-70s to mid-80s range, a sign that rapid expansion has added pressure but not destabilised operations.

IndiGo’s on-time performance softened after 2022 but stayed within a broadly stable operating range

It marks an under-the-radar structural shift, one that quietly strengthens IndiGo’s pricing leverage before it shows up in quarterly results.

And if current deployment patterns continue, Thurro’s forward data suggests this higher competition-free plateau could support higher margins through FY26.

Cover photo credit: X/@IndiGo6E

View disclaimer

This is just one slice of what the data shows. On Thurro Answers, you can access the underlying charts, extend the analysis, and explore a broader set of aviation indicators, from capacity deployment to competitive market share, using the same data that powers this piece. Start a free trial to build your own informed view.

Unlock the power of alternative data

Do not just follow the market — stay ahead of it. Thurro helps you transform raw filings and alternative datasets into actionable insights.

Explore Thurro AltData Book a demo