AI Financial Research Assistant Built for Decision-Grade Intelligence

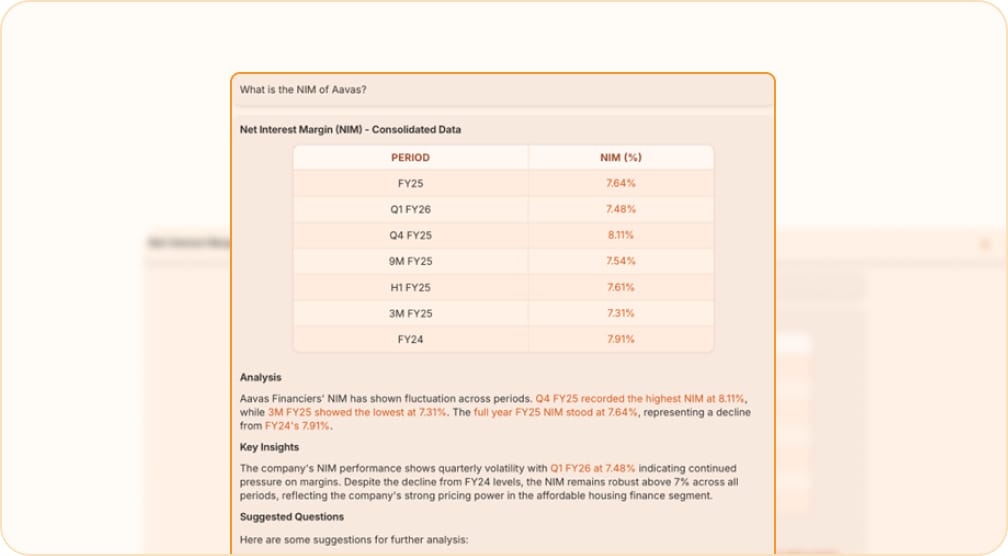

Thurro Answers is an AI financial research assistant designed for institutional decision-makers who require accuracy, transparency, and speed in their research workflows. It enables users to ask complex financial, regulatory, and strategic questions and receive precise, source-verified answers grounded in curated data—without relying on generic web-trained AI models.

Built on a proprietary data lakehouse covering millions of daily data points across financial filings, regulatory disclosures, transcripts, and alternative datasets, Thurro Answers transforms fragmented information into decision-ready intelligence. Every response is traceable to its original source, allowing analysts to validate insights, audit conclusions, and confidently act on findings.

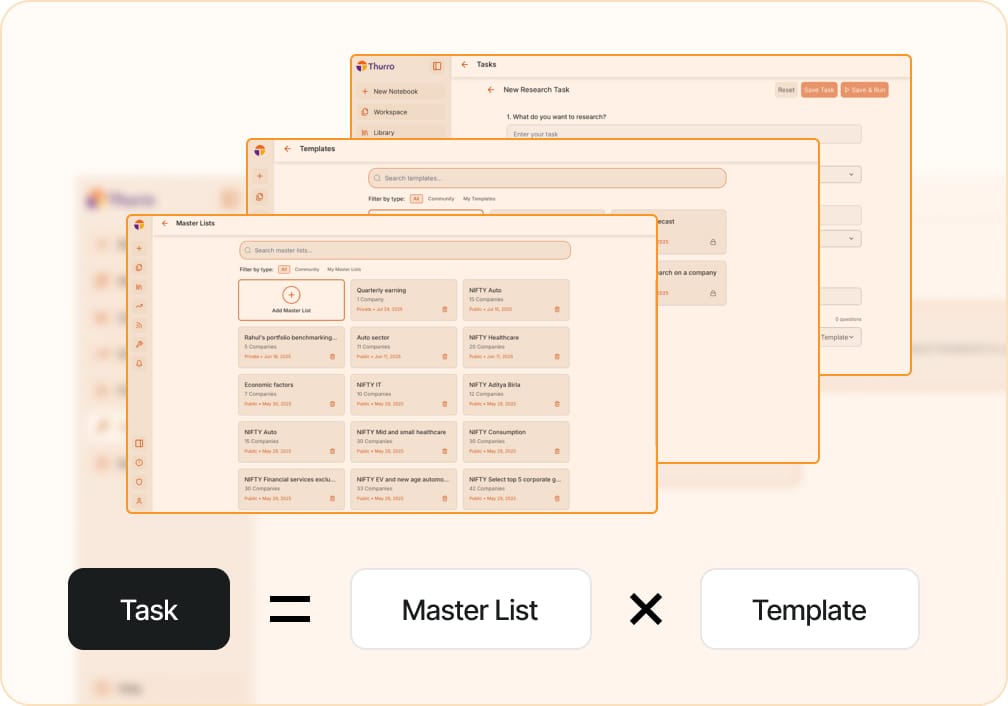

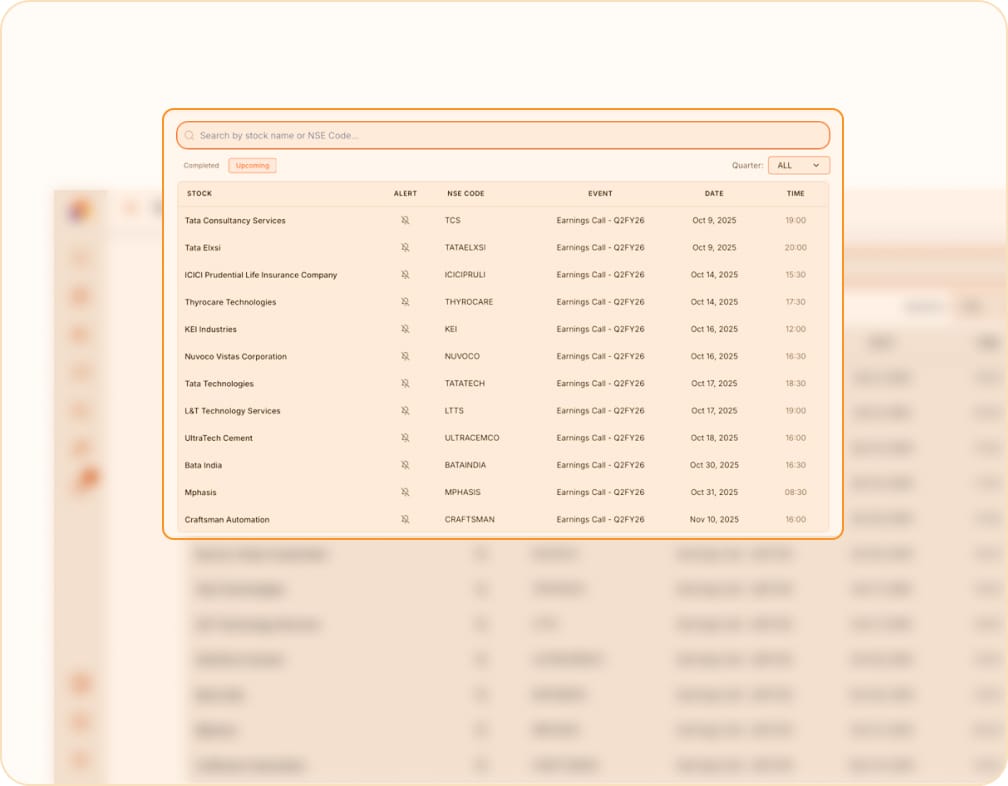

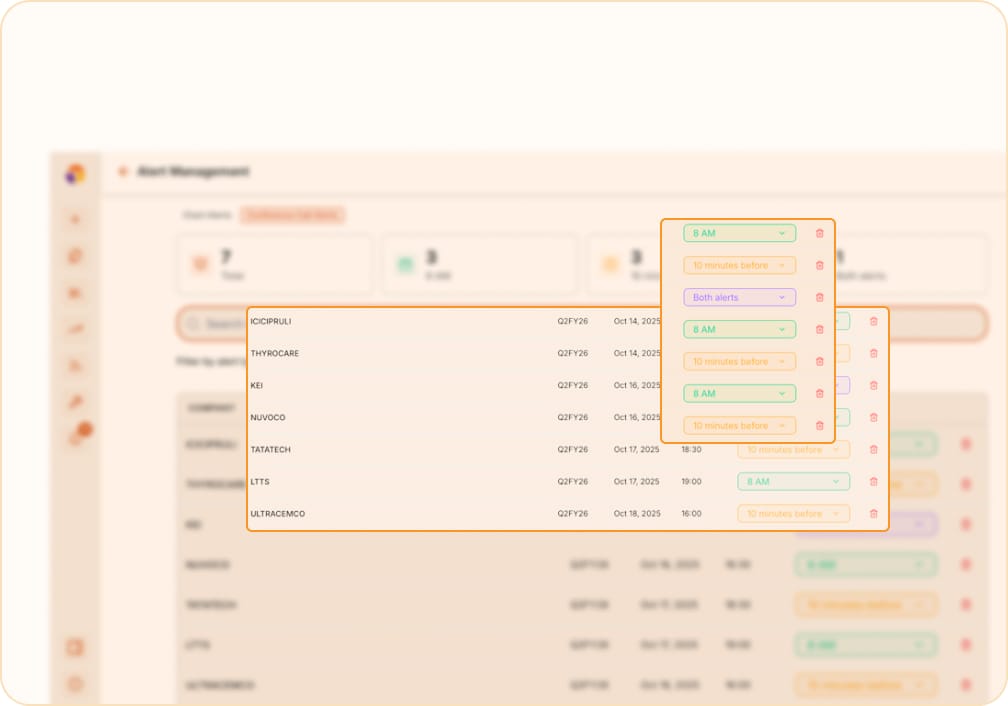

The platform supports advanced research workflows through features such as unified intelligence queries, shareable research notebooks, automated task templates, conference call intelligence, and alert management. These capabilities help research teams reduce manual effort, accelerate analysis, and maintain consistency across investment research, market monitoring, competitive intelligence, and strategic planning.

Unlike generic AI chatbots, Thurro Answers is purpose-built for professional use—prioritizing explainability, data integrity, and institutional trust over speculative or unverified outputs.

Real-time insights grounded in regulatory data

Ask complex questions and get precise, source-backed answers

Key benefits

Key features

Thurro Answers in action

See how professionals across sectors use Thurro to solve complex research problems, faster, deeper, and with full traceability From financial analysis to competitive intelligence, market shifts to strategic planning — Thurro is built for real use cases, not generic demos

Browse real Notebooks and explore the research behind the results.

Why Thurro Answers works better for decision-makers

Thurro AnswersPurpose-built for decision-makers | Generic AI chatbotsGeneral-purpose conversation |

Curated DataLakehouseBuilt on 800+ authoritative sources, 25 million+ daily data points, 5+ years of Indian financial and alternative data | Web-scraped trainingTrained on general internet data with limited financial or corporate depth and currency |

Decision-ready insightsDelivers structured analysis, not shallow summaries. Every answer includes citations and sources | Surface-level responsesProvides conversational answers without deep analysis or reliable source verification |

Unified data analysisCombines structured and unstructured data: filings, transcripts, alternative data, market intelligence | Limited data integrationCannot access real-time financial data, filings, or proprietary business intelligence |

ReliabilityTransparently states what it does not know, offering only accurate, available data | Hallucination riskMay generate plausible sounding but incorrect information, especially for specific queries |

Domain expertiseOptimised for corporate strategy, M&A, equity research, and investment analysis | General knowledgeBroad but shallow understanding across domains without specialised research capabilities |

Workflow efficiencyStreamline your workflow with automated portfolio analysis (watchlists, templates), organized research notebooks, and efficient background processing for large-scale data | Repetitive dragInefficient workflows often stem from manual, repetitive querying, a lack of systematic portfolio monitoring, inconsistent analysis frameworks, and the need for real-time interaction with |